Transforming the group retirement experience

You may also like

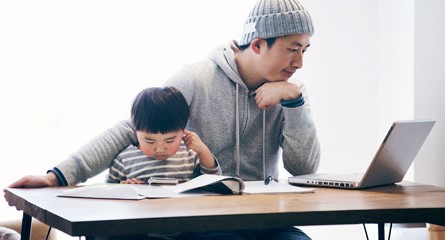

Health and Financial Wellness Approach

See insights into the strong relationship between financial and personal wellness, and its impact on engagement and productivity.

We’ve redesigned our member site homepage to provide members with the most relevant information, as soon as they sign in.

Learn how our new member engagement program help boost members’ plan engagement, productivity, and overall well-being—and how you can be part of it.

Members who want to make a withdrawal from their account will be able to do so exclusively through their secure member site if their plan allows it. See how this makes their experience better.

Our third annual survey of Canadian workers reveals that 72% are under financial stress, which follows them to work and affects absenteeism and productivity. This can be a real cost to employers’ bottom line. The good news is that employers are uniquely positioned to provide support that drives positive saving and investing behaviours, which can help to reduce stress and increase productivity.

A summary of the issues and proposed changes most important to plan sponsors.

The new public site features more personalized content and helpful tools and resources to help your members manage their financial well-being.

The newest dashboard, available now on your sponsor secure site, tells you the story of your members’ participation from the time they join a plan to the time they leave it.

Starting this spring, members can put money in their plans, and find tools, guidance, and more—all on Manulife Mobile.

In light of growing research and increasing investor interest in environmental, social, and governance (ESG) funds, BlackRock has announced changes coming to their Canada LifePath Index Funds.

This dashboard on the sponsor secure site helps you quickly see how your members engage with their plan online.

We’re deeply saddened by the violent conflict in Ukraine which has displaced so many. The ripple effects of this crisis are being felt around the world.

Financial well-being is an important part of life. The Financial Wellness Assessment is a key tool to help you gain insight into financial health.

The i-Watch® platform evolved a lot in 2021 and is heading in a very exciting direction. Check out our Year in Review.

Get a look at how your members engage with their program through our Contact Centre.

The new funds provide modern solutions for group retirement plans.

These additions help provide new options for plan members looking to build a diversified Shariah aligned portfolio.

Redefining retirement means looking past just dollars and cents and seeing a complete picture of life after work. Now, our Retirement Redefined resources are easier than ever to access. Employees will have access to a library of material to improve their financial wellness and get ready for retirement.

On July 19, we launched Manulife ID for advisors and sponsors. As part of the next phase of the Manulife ID launch for Group Retirement, we’re introducing Manulife ID for members soon.

See how this dynamic, interactive tool can help you quickly get the insights you need to make decisions about your plan.

As part of our commitment to providing you and your employees with educational retirement content, we’ve expanded the topics available in the Member Education Resource Centre.

Complementary access to additional savings and retirement income plans!

We’re adding Canadian, Global and International Equity funds, and more.

Plan members will be able to submit beneficiary information through the member site.

Find your last 12 months of charge invoices all in one place.

We’ve been busy updating the My Retirement Tools page and calculators to better help your members plan for retirement.

Our global head of OCIO and fiduciary solutions shares his insight on how these new strategies may be a boon for smaller pension plans and institutional asset owners.

Manulife’s Year in Review re-visits the significant moments that shaped your members’ experiences in 2020.

Canadian’s are feeling unprecedented amounts of financial stress, caused by the pandemic. What are ways that we can help make your lives easier?

March is Fraud Prevention Month, and we’ll be hosting a new ‘Internet scams – Protect yourself and your money’ webinar to help members get a better understanding of how to identify scams and protect themselves online.

Our Group Retirement webinars were a great success in 2020 and we plan on continuing that success into 2021. Learn more about what we’re planning and how your employees can participate.

Putting money in an RRSP is a good way to save for retirement and reduce taxes heading into the new year. And with the events of this year having put a spotlight on finances and the importance of preparing for tomorrow, now is a good time to remind your members to contribute to their RRSP.

But what does that mean for this year’s RRSP season?

We’re updating the income levels associated with the five lifestyle scenarios to be in line with the current cost of living.

Learn how we are working to make the sponsor secure site experience the best for group retirement plan administrators.

To better understand the effects of financial stress on people, Manulife conducted its annual Financial Stress survey.

Check out Manulife’s webinars for plan members for Financial Literacy Month.

For Group retirement plan sponsors, the secure site now includes a new look, help with contribution submissions, and online payroll inquiry functionality.

Money problems have been a key factor in causing stress for many years. Now, COVID-19 is compounding that stress and more and more Canadians are seeking financial support.

Now, as we look forward to returning to work, we must face new questions about how we can do so safely and smartly.

We’re always looking for ways to make things easier and secure for plan members. Here are the new features available on Manulife Mobile.

We surveyed our members about which topics they’d like to hear about next. The number 1 response was to learn more about RRSPs and TFSAs. Which one is a better option for them?

We want to make the lives of our plan members easier, and that includes giving them easy and secure access to manage their group plans.

We’ve added three BlackRock funds to the i-Watch platform, and two NEI funds are changing names and objectives.

Coming soon, plan members will have a new way to send documents.

A safe, secure and convenient digital experience is more important now than ever.

The right choice can help you improve pension outcomes and save time and money.

Your sponsor secure site gets a new look, and that’s just a start to your new digital experience.

With market volatility in the news, it’s a good time for members to learn more about investing. Our new webinar helps employees understand the basics – time, knowledge and risk.

By answering one question, plan members can let us know what matters to them most.

In late December, several cases of pneumonia were reported in Wuhan City, Hubei Province of China. Chinese authorities confirmed that they had identified a new coronavirus (a family of viruses that range from the common cold to more severe viruses).

Many people vow to save in the new year but they may not understand their options. Promote our new webinar that helps employees learn about their retirement plans.

Learn how Manulife's new look for online accounts is improving plan members' online experience.

Get a sneak peak at Manulife's soon-to-be-launched homepage for the plan member site.

Find out from Manulife how going digital prompts plan members to save an average of 2.7 times more in assets.

Learn how new navigation makes it easier for plan members to find the information they need on Manulife's Support page.

Learn about an engaging new video series from Manulife that teaches plan members about investments in easy-to-understand terms.

Read about Manulife's Wellness Report (for business owners) to understand how employee health risks may impact your organization's bottom line.

Offering financial guidance can make all the difference for both employees and organizations.

Learn the 18 moments in life plan members say cause them the most financial and emotional stress, and what Manulife is doing about it.

On November 21, 2018, due to organizational changes at the fund manager level, Manulife Asset Management will close their International Equity strategy.

Invesco, NEI, MAM and Meritas have recently notified us of changes they’ve made to their fund names.

We’re removing the Manulife CI Harbour Growth & Income Fund from our investment platforms.

In May, we told you that Manulife Asset Management (MAM) is now Manulife Investment Management (MIM).

Plan administrators with plan members invested in the NEI International Equity Fund (AllianceBernstein) will see a name change for this fund on their statement.

For business owners, the Manulife NEI International Equity RS Fund replaces a previous fund and now qualifies for the Responsible investing program.

Sleepless babies often mean sleepless nights for news parents. Here are a few tips and tricks which might help you rest a bit easier.

Digital tools play a key role in how plan members can manage their financial health.

See insights into the strong relationship between financial and personal wellness, and its impact on engagement and productivity.