On this page

Instruction: Change of selection promptly shifts the focus to a matching heading further down, on the same page.

Start your journey to better health

Welcome! We’re excited to have you with us. As a valued member of your organization’s benefits plan, you’re in the right place to access the tools, guidance, and resources that will help you and your eligible family members make the most out of your benefits. We’re here to support you and your family in achieving healthier, happier lives.

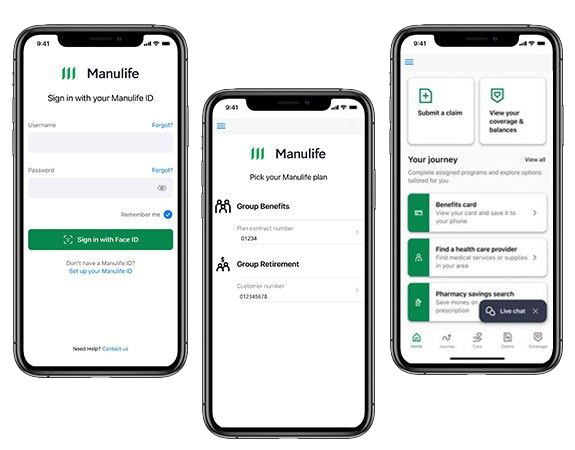

Tap into better health and get rewarded with the Manulife Mobile app

Access your benefits plan anywhere with the Manulife Mobile app and earn Aeroplan® points for exclusive rewards. Our app provides you with real-time support and a range of features to help manage your health needs:

- Connect with care. Access health services, tools, and resources available through your benefits plan, right from the app.

- Learn more about your benefits. New resources and features are here to help you understand the coverage you have as part of your benefits plan, how to use it, and when.

- Easy claims submission. Submit claims on the go and check their status with ease.

- Coverage details. Access and review your benefits coverage whenever you need to.

- Digital benefits card. Download your benefits card for convenience.

- Earn Aeroplan® points. If you choose to participate, link your Aeroplan account to your Manulife mobile account to earn points for completing health and benefits-related, activities, as well as participating in challenges. You can redeem your Aeroplan points for a variety of rewards, including flights, hotel nights, car rentals, merchandise, gift cards, and more.1

- Participate in challenges. Stay engaged and motivated towards achieving your health and wellness goals as you participate in a variety of friendly competitions, as part of a team or individually.

- Health resources. Explore a wide array of health-related articles to support your wellness journey.

Join the nearly 1M Canadians already using our Manulife Mobile app!

85% of our app users have tried a health feature, showing they're eager to explore health content and get tips for a healthier lifestyle.2

Download the Manulife Mobile app

You can use the app to submit claims on the go, check on a claim’s status, read coverage details, download your benefits card, gain access to a wide range of health-related articles, and more. To sign in, you would use the same login information used to sign in on the website. (Note: Dark mode is available on the iPhone for version iOS 13 and higher.)

Scan the QR code with your mobile device and download the app! Or, visit our resource page to learn more.

Chat with us

Get your questions answered in real time during our online hours. Simply download the Manulife Mobile app, then click on 'Live chat' (bottom right-hand corner of your mobile device).

Use the app to submit claims on the go, check on a claim’s status, read coverage details, download your benefits card, gain access to a wide range of health-related articles, and more.

We’re online from 9 a.m. to 7 p.m. EST, Monday to Friday.

You may also have access to optional health insurance

In addition to basic life, some plan sponsors offer members the chance to buy additional (i.e., optional) life insurance and/or critical illness insurance. Your benefits booklet includes details on whether your plan includes such options, and how much they cost. Or, your plan administrator or human resources department can provide more information.

Optional life insurance

Optional critical illness insurance

Explore programs that support healthier lives

Mental health & counselling services

Personalized Medicine Program