Most searched topics

Visit these resources for information on top-searched subjects (e.g., signing in, claims, forms)

There’s more help here if you need it

Group Benefits plans

Financial matters

Help with claims

More support

Frequently asked questions

Group Benefits Plans

To see what services your plan covers:

- Sign in to your plan

- Find and click on Coverage

- Under Your Benefits, click on View Benefits Booklet

Don’t have an online Benefits Booklet? Check with your plan administrator at work or contact our Customer Service Centre.

Individual Health and Dental Insurance

To see what services your plan covers:

- Sign in to your plan

- Click on Contract and benefits

Costco, alumni or professional association members

- Sign in to your plan

- Click on Contract and benefits

Group Benefits Plans

You can see your most recent claims on our website or in the app.

On our website:

- Sign in to your plan

- Find claims on the home page

In our app:

- Sign in to your plan

- Click Claims

To search for specific claims:

On our website:

- Sign in to your plan

- Click on Claims

- Click on Claims Hub where a list of your claims should appear

For Individual Health and Dental Insurance

- Sign in to your plan

- Your recent claims will appear on the home page

For Costco, alumni or professional association members

- Sign in to your plan

- Your recent claims will appear on the home page

Please print and complete the Drug Prior Authorization form.

Firstly, please be aware every group benefits plan is unique, but we’ve provided some general guidance below.

If you and your spouse have coordinated your coverage and named each other on both accounts, you should be able to submit claims to each other’s insurance plans.

Here's how it usually works: First, submit a claim to your own plan. If there are remaining expenses, submit those to your spouse's plan. This can help you get reimbursed for up to 100% of your costs.

Once you're registered on each other's plans, claims can often be processed automatically. For instance, a dentist might submit claims to both plans without you needing to do anything extra.

Our guide explains how to make claims for yourself, your spouse, and your children.

Want to manage everything in one place?

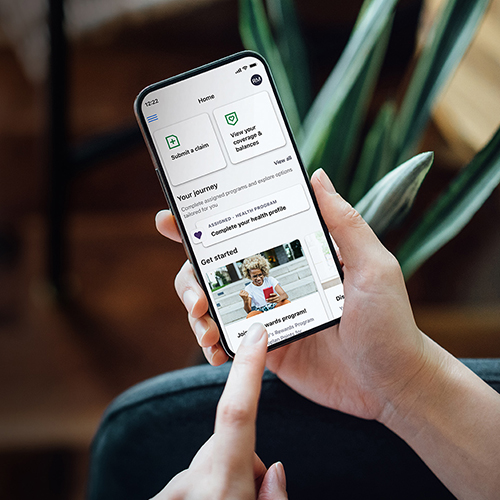

Our Manulife Mobile app makes it easy to find claims, check your benefits balance, connect with healthcare providers and lots more.

Firstly, please be aware every group benefits plan is unique, but we’ve provided some general guidance below.

A 'Reasonable and Customary' (R + C) amount is the standard price an insurance company expects to be charged for a specific treatment in your area.

When you make a claim, your insurance provider checks the typical cost of the service based on:

- Local rates in your province

- Professional fee guidelines for that type of healthcare

This means you might not get full coverage if a provider charges more than the standard rate.

Want to manage everything in one place?

Our Manulife Mobile app makes it easy to find claims, check your benefits balance, connect with healthcare providers and lots more.

No, it will only cover limited expenses. Most medical expenses abroad – like ambulance services, prescription drugs, private hospital fees, or emergency dental care – may not be covered at all.

You can buy most travel insurance plans right up to your departure date. However, some special add-ons have specific purchase windows.

For example, our Cancel For Any Reason Rider must be bought within 7 days of booking your trip.

We recommend getting travel insurance as early as possible to maximize your coverage.

Do you have the Manulife mobile app?

Whether you have a group benefits or group retirement account, our Manulife Mobile app makes it easy to find claims, check your benefits balance, connect with healthcare providers and lots more.

Scan the QR code with your smartphone and download the app! Or, visit our resource page to learn more.

Need more help?

We’re here.