It's personal: the value of customized financial advice for employees

Integrated support: Work, wellness, and wealth

In the area of personal finance, a common story is that most people experience the same, or similar, financial stages throughout their lives that usually look like this:

- Stage 1-Early career years; early saving years

- Stage 2-Family and career building years; buying a home, saving for children's education

- Stage 3-Pre-retirement years; paying off mortgage and other debts

- Stage 4-Early retirement years; decumulation of savings, lifestyle spending

- Stage 5-Later retirement years; health care spending; estate planning

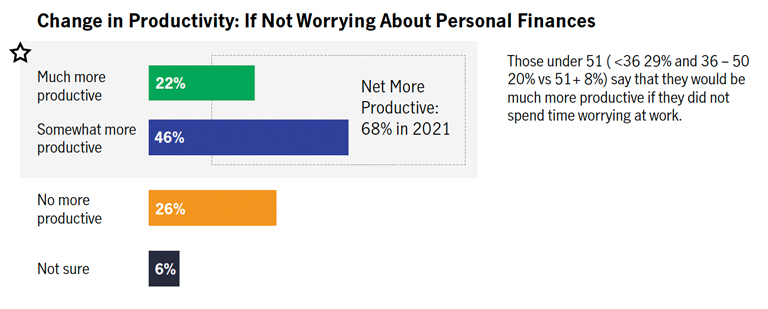

But today, how many of us experience a "one-size-fits-all" financial reality? Social and economic changes, not to mention a global pandemic, have impacted relationships, career, and personal finances. According to the 2021 Manulife Canada Retirement Study: Stress, Finances, Well-being (The Manulife study), nearly twice as many workers report major stress, both general or financial stress, during the pandemic compared to before the pandemic. Respondents were also more likely to say they worry about their personal finances at work every day. Among those who worry, close to 70% say they would be more productive at work if financial worries did not intrude.

Because of these changes, the value of advice has never been higher. The key value of a personalized approach to financial advice is it continues to be relevant as your employees’ lives evolve in both expected and unexpected ways.

Source: Manulife Canada Retirement Study: Stress, Finances, Well-being

How evolving life patterns affect finances—today and tomorrow

Whether by personal choice or circumstances or a combination, most people's lives don't automatically fit the same narrative. For example, amid the pandemic, almost a quarter of Canadians reported they are considering switching jobs. This could be just one of 15 different jobs (PDF) working age Canadians might have throughout their careers. Career changes may involve retraining or relocating, which could mean reassessing financial goals and timelines.

Personal and family life has also become more varied. The number of one-person households has surpassed couples with children, whose numbers have declined since 2001. Single-person households now account for nearly 30 per cent of all households.

These changes all have a direct effect on personal finances. Changing jobs or careers may require retraining and the need to dip into savings or reduce the pace of saving to fund the costs of continuing education. The rise of single-person households requires individuals to increase their savings for emergencies and retirement and it may also affect their risk tolerance in the choice of investments.

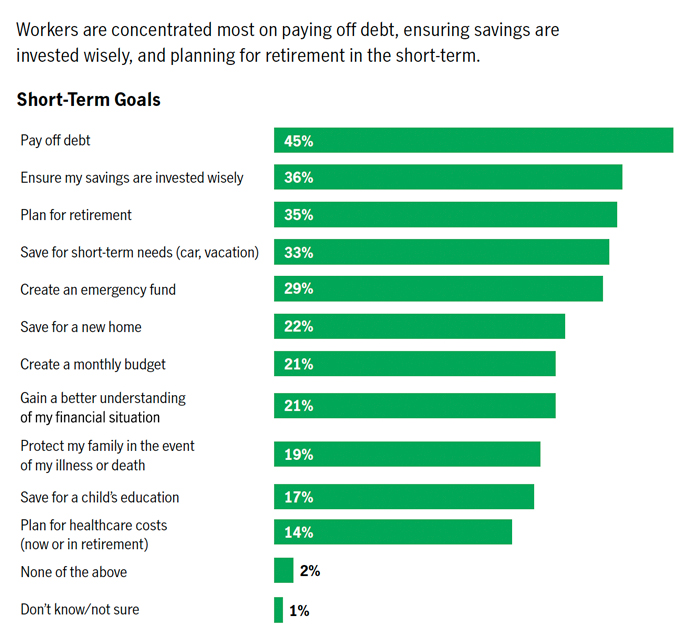

The Manulife study showed employees’ top three financial goals include paying down debt, ensuring savings are invested wisely, and planning for retirement. Access to sound financial advice in the workplace is key to helping employees be less stressed and more productive.

Source: Manulife Canada Retirement Study: Stress, Finances, Well-being

The value of advice for employees

During the pandemic, with many people working from home or on flex time, a common email signature had become, " My working hours may not be your working hours." A corollary in financial advice could be: "My retirement or debt reduction goals may not be yours." Each person has different goals and timelines, and financial advice needs to be personalized. Numerous studies show the value of advice. For example, advised clients have greater net worth over time, nearly 4 times more over a period of 15+ years, and are better at saving than clients without an advisor.

Advised clients are more successful at saving

80% of investors say their advisor helped them save.

Source: Canadian Investors' Perceptions of Mutual Funds and the Mutual Fund Industry, Pollara 2019.

The value of financial advice comes from three elements:

- Employees benefit from the professional and technical expertise of advisors who provide guidance on a range of products and services customized to each employee's unique needs.

- Industry experience means advisors can help employees navigate various market and economic cycles with greater peace of mind.

- Personalized advice means understanding the financial needs of employees and providing the right advice—at the right time—to help them save and invest wisely.

According to The Manulife study, Canadians surveyed who work with a financial advisor said they were optimistic about the year ahead. It also found most employees are interested in receiving retirement strategy recommendations from their employers and 80% said having a work-based retirement plan is a critical company benefit. A majority also said that having a financial wellness program through their employer would make them more likely to recommend someone to their company.

The concerns and stresses employees have cut across all aspects of life and so should the solutions – integrated advice and support is essential to helping your employees navigate and feel confident about their finances today and tomorrow. Filling the information gap is where employers can step in to give workers greater visibility on where they are on their financial path.

The benefits to your members of working with an advisor are clear: less financial stress, higher productivity at work, and greater lifetime savings.

Contact your Manulife representative for more information.